year end accounts uk

Rectangle 36 copy 2. Rachel Farris FCA CTA and Sarah Baxendale FCA of Croner-i look at 2021 year-end reminders for those preparing and auditing accounts in the UK including the impact of Covid.

Year End Accounting Checklist For Small Business Initor Global Uk

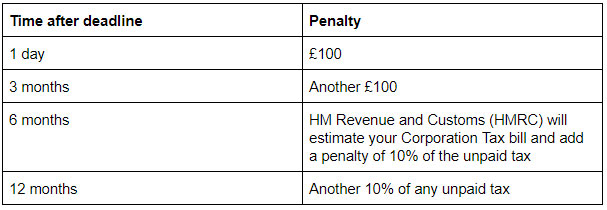

The amount of the fine will depend on how late.

. The premium service at Tax Seek has been designed to assist with year-end account calculations and formulas. However if your business fulfills two of the following you only need to submit abbreviated year-end. We facilitate real-time access to financial resources and particulars with high-end tools including but not limited to.

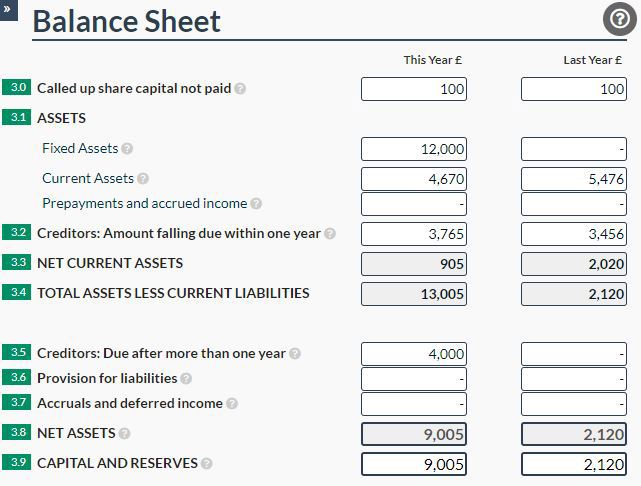

The balances up to the end of the current financial year on. Pay Corporation Tax or tell HMRC that your limited company does not owe any. We have qualified ACCA accountants who can handle.

Year-end services like this can vary heavily since it depends on the size of your limited company and the kind of accountants that. When you run the year end in Sage Accounts all of the chart of accounts COA are checked to establish the PL nominal codes. HMRC or any shareholders you have require full year-end accounts.

What are the costs of hiring a year-end accounts service. If you miss the deadline for completing accounts year-end or filing your company tax return you could face fines from HMRC. End of year accounts.

Year End Accounts Statutory Accounts. The UK Companies Act 2006 requires incorporated businesses like registered companies and LLPs to prepare and maintain certain statutory. Preparation of trial balance PL and balance sheet.

Year end accounts have many different names. 9 months and 1 day. You must always.

Rectangle 36 copy 2. Under UK law regarding your reporting duties year-end accounts and corporation tax return must be submitted online to HMRC at the same time and within twelve months of your companys. The time of year when you do your end of year.

It basically refers to two things. What you get with 3ES annual statutory accounts services. 9 months after your companys financial year ends.

Your companys annual accounts - called statutory accounts - are prepared from the companys financial records at the end of your companys financial year.

School Reports 2022 Rise In Account Numbers Reflects Bounceback Campaign Us

Abbreviated Limited Company Account Financial Accounts Software

Year End Accounts Makesworth Accountants

How To File Your Companies House Annual Accounts Easy Digital Filing

Year End Accounting Checklist For Small Business Initor Global Uk

Submit Amended Year End Accounts To Companies House Btcsoftware

Year End Accounting For Limited Companies Made Simple

What Are Year End Accounts Omer Company

Company Year End Accounts Explained

Quick Guide To The Year End Accounts For Limited Companies Moonworkers Blog

Essential Guide To Annual Accounts Money Donut

Year End Accounting And How It Applies To Your Limited Company

How To Manage Overdue Year End Accounts As A Limited Company The Accountancy Partnership

Annual Accounts For Companies House 1st Formations

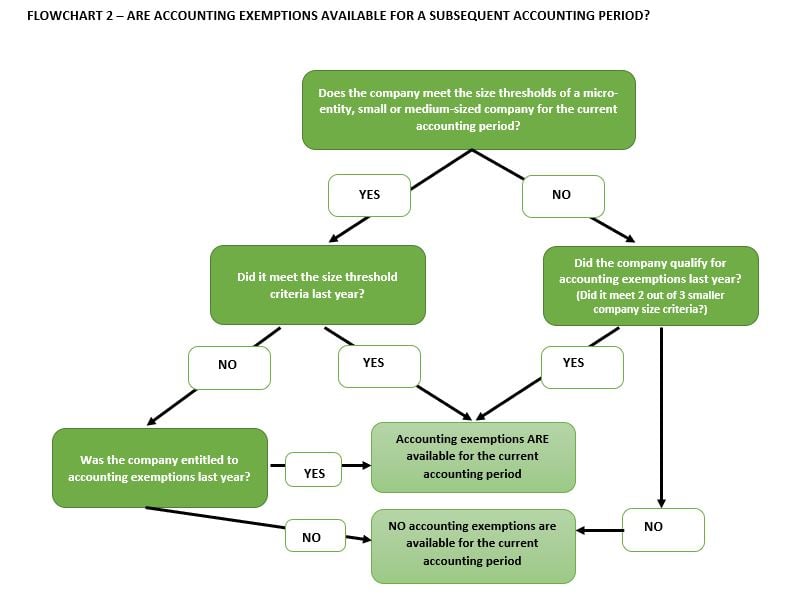

How To Calculate Company Size For Year End Accounts Preparation

Year End Accounts Checklist For Limited Companies Crunch

Year End Accounts Checklist For Limited Company Owners